KOA RIDGE LENDERS

We've partnered with Hawai'i's top lenders to provide you with the lowest rates and the most comprehensive mortgage financing services.

For 2024, Fannie Mae expects lower mortgage rates will boost new home sales and shore up home prices in the near-term. This may be a good time to think about a brand-new home.

Tips to Consider when Buying in Today's Market

For homebuyers who want to buy now due to a change in lifestyle like getting married, starting a family, downsizing, or because you are looking for more financial stability, here are a few things to consider.

Mortgage loan officers can show many homebuyers that you may have more options than you think. If you are considering a home purchase right now, our designated project lenders are here to help..

Remember each market is local and we recommend you analyze the nuances of the neighborhood.

Here are three (3) instances in which it might make sense for you to consider buying now:

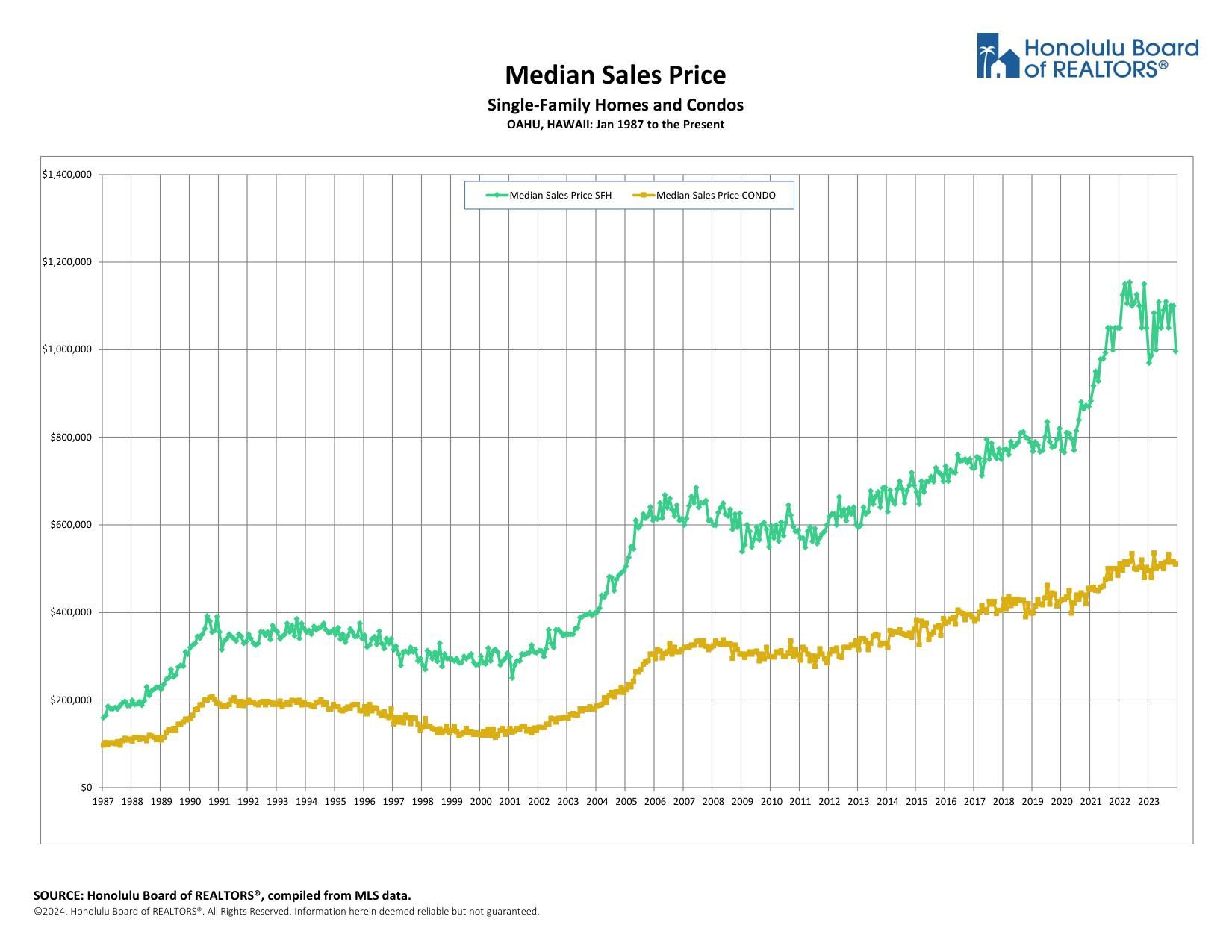

Tip No. 1: Home values in this area are holding steady and new construction costs while improving are still high. (See the Median Sales Price trend chart above reflecting sales since 1987). If you are financially able to purchase now please remember, your home is your home, not an investment. At some point in the future, you may need to access the equity for your personal circumstances. If you have a long-term time horizon – history has shown that you don’t have to be perfect to experience good results.

Tip No. 2: Inventory is extremely limited. New Home Inventory is an option.

It is important to determine where it is you want to call home. In the general resale market, competition for homes is still occurring and some buyers are not winning the bid. If that is the case, consider new homes where everyone has equal footing – either first-come, first-serve, or a lottery. Another benefit of new construction is that much of what is available in the resale market is in need of remodeling or updated maintenance. New homes today are typically smaller and require less maintenance.

Tip No. 3: While the 30-year mortgage rate currently sits below 7% with points, this isn’t unusual.

Twenty-seven out of the last 50 years have seen mortgage rates at or higher than current levels, and rates have exceeded 5% in nearly 38 of those years. If you are looking to purchase at current interest rates, consider the opportunity to refinance in the future.

See our experienced loan officer teams for assistance and let us know if we can be of service.

Whichever home type you are looking to buy at Koa Ridge, First Hawaiian Bank offers a complete range of mortgages and home loans to fit your needs. We’re committed to providing outstanding service every step of the way.

learn more >

Make your dreams a reality with affordable Mortgage Loan Options from Central Pacific Bank. We find the right loan product to meet your mortgage financing needs, with no to low down payments, and promotions for new home purchases.

Learn More >

We can help you realize your dream of homeownership with a wide array of home loans and mortgage programs to meet your needs.

Learn More >

If you’re in need of a lender for your new home purchase, you’ve come to the right place. SimpliFi Mortgage by Bank of Hawaii can help you get the right mortgage fast and easy, and with experts that understand the market, you’ll be at an advantage.

Learn More >

‘Okipu‘u at Koa Ridge

‘Okipu‘u, known in Hawaiian culture as clearings in the ancestral forest, allowed sunlight so shine through the dense forest and reach the earth below. This light source facilitated the birth of new life-giving plants in an environment where they could grow and thrive. This “new life” concept provided inspiration for today’s Koa Ridge.

Learn More >